Ace Npv And Irr Excel Template

The Cost of capitalhurdle rate that would give the project an NPV of 0.

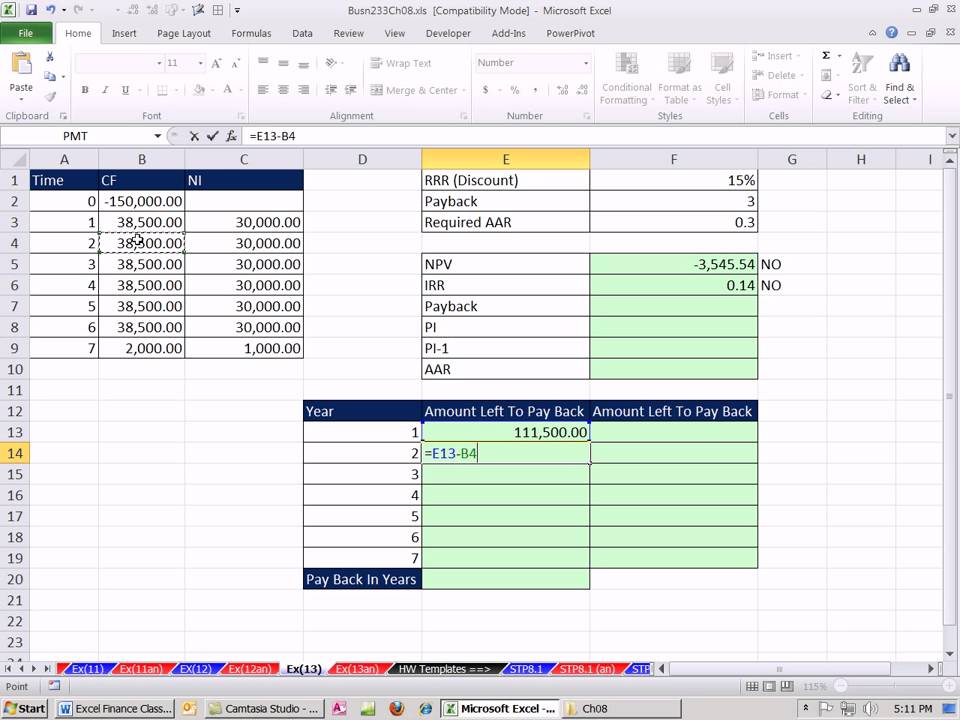

Npv and irr excel template. IRR and NPV in Excel. The NPV calculation in this template can be used to calculate the investment return after inflation by simply specifying the average annual inflation rate as the discount rate. Once you input your estimated cash flows the NPV Calculator Excel Template displays you the Net Present Value and the Internal Rate of Return of the project and much more.

What does it mean. Similar to the IRR. If the NPV of an investment is zero it.

For more information please see How to calculate CAGR in Excel. So the IRR -26 is the rate at which you are losing money. Alternatively the NPV calculation can also be used to determine whether the investment return exceeds a required return on investment by simply specifying the required.

We can calculate the IRR by using the Excel IRR function. If you need to do IRR calculation in Excel on a regular basis setting up an internal rate of return template can make your life a lot easier. NPV calculation in Excel can be tricky.

You will notice that the IRR is -26. Therefore only approximate methods are used in practiceFor example you might use the GoalSeek function in Excel. 9900 by Julian Scheeff Real Estate Multi Family Development Excel Model.

This XIRR vs IRR template allows you to differentiate between the use of IRR and XIRR functions to compute the internal rate of return. Model npv irr real estate financial model. Series payment type None Uniform Gradient or Exp Grad Value A G or Eo G for Exp Grad.