Neat Tax Bracket Spreadsheet

Shouldnt it be 1905.

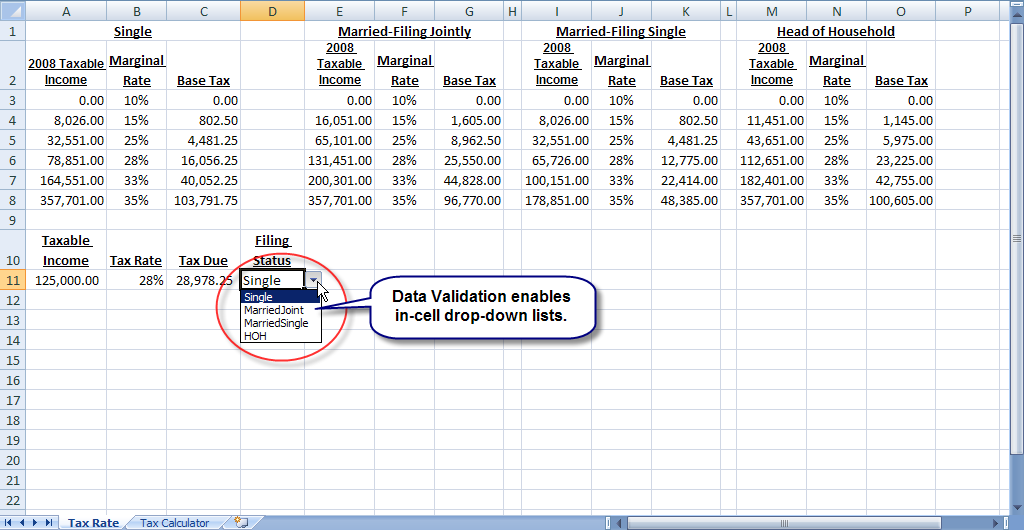

Tax bracket spreadsheet. The US Tax system is progressive which means people with higher taxable income pay a higher federal tax rate. New York has eight marginal tax brackets ranging from 4 the lowest New York tax bracket to 882 the highest New York tax bracket. 15 for personal incomes of between 39376 to 434550.

7000 X 15 percent 1050 federal taxes owed onlong-term capital gains. I dont understand the values that are in the downloaded 2018 spreadsheet tax. Once you have downloaded the bracket you need you will be able to directly type in team names dates times and locations of games.

Each marginal rate only applies to earnings within the applicable marginal tax bracket. Short-term capital gains tax is a tax on profits from the sale of an asset held for one year or less. Tax on Capital Gains.

Calculation of tax on short-term capital gains is simpler than that on long-term gains. On the other hand long-term capital gains tax rates are much lower ranging between. Taxable Income Tax Bracket Floor Min Max 100 1905000 7739900 120.

For short-term gains the gain is added to the total income and then the Income Tax is calculated based on the tax bracket that you fall in. The entire 7000 is taxed at the 5 percent state tax bracket. The short-term capital gains tax rate equals your ordinary income tax rate your tax bracket.

They also have a guide on rates for foreigners living in Australia. Accordingly your tax bill depends on your federal income tax bracket. Thats because short-term gains are taxed as ordinary income at the normal 2019 tax bracket ranges of 10 12 22 24 32 35 and 37.